FAQ: How Do I Credit a Migrated Invoice?

Issue

A client has invoices from their previous system that need to be credited because VAT was charged in error. The overcharged VAT amount is due back to the client.

There are two scenarios depending on whether the invoice exists in the current system or only in the previous system.

Solution

Option 1: Invoice Exists in the Current System

If the original invoice is recorded in the current system, it can be credited and reissued for the correct value.

- Unfinalise the bill. This will return any payments made to office credit funds.

- Edit the bill and update the VAT rate on the fees.

- Finalise the bill again.

- Pay the corrected bill using the office credit funds.

- The remaining balance in office credit funds represents the refund amount. Post an office-to-client transfer to move this into the client account, then refund the client from there.

Option 2: Invoice Not Recorded in the Current System

If the invoice does not exist in the current system and cannot be credited, or if a credit value invoice cannot be produced, there are two possible approaches:

Method A: Adjust the Next Bill

Reduce the next bill by the refund value. This effectively offsets the amount owed, but does not generate a refund payment to the client. Note that the next bill must exceed the refund value to ensure a positive balance overall.

Method B: Refund Directly from the Nominal

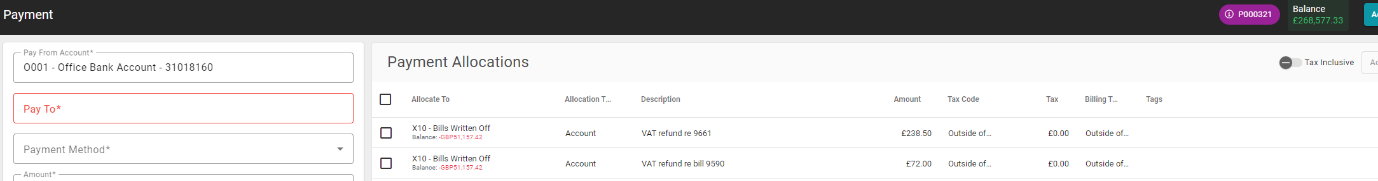

- Post a payment from the office bank for the refund amount.

- Itemise by adding an allocation row for each bill if needed. Set the allocation to “Outside of Scope.”

- Choose an appropriate nominal account for the allocation (for example, “Bills Written Off” if the refund will not be reclaimed).

- Transfer the funds in the bank to post as a client receipt on the matter, then process the refund from the client account.

VAT Reclaim

If the refund amount will be reclaimed from HMRC, process this through a VAT return adjustment. Credit the nominal account used for the refund and debit VAT Input, selecting Outside of Scope for the VAT rate on the adjustment line.